Unlike long-term investing, trading often has a short-term focus. A trader buys a stock not to hold for gradual appreciation but for a relatively quick turnaround, often within a set time period—whether that be a few days, a week, a month, or even a quarter.

And of course, day trading, as the name implies, has among the shortest time frames of all. The day trader’s analysis may be broken down into hours, minutes, and even seconds—and the time of day when a trade is made can be an important factor to consider.

Is there a best day of the week to buy stocks? Or a best day to sell stocks? Does a best time of year to buy stocks exist? How about a best month to buy stocks, or to sell them?

In this article, we’ll show you how to time trading decisions according to daily, weekly, and monthly trends.

Best Times of Day to Buy or Sell Stocks

First thing in the morning, market volumes and prices can go wild. The opening hours are when the market factors in all of the events and news releases since the previous closing bell, which contributes to price volatility.

A skilled trader may be able to recognize the appropriate patterns and make a quick profit, but a less skilled trader could suffer serious losses as a result. So if you’re a novice, you may want to avoid trading during these volatile hours, or at least within the first hour.

However, for seasoned day traders, the first 15 minutes following the opening bell is prime time, usually offering some of the biggest trades of the day on the initial trends.

The opening period (9:30 a.m. to 10:30 a.m. Eastern Time) is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off. Once that happens, trades take longer and moves are smaller with less volume.

If your day trading involves index futures such as S&P 500 E-Minis, or an actively traded index exchange-traded fund (ETF) such as the S&P 500 SPDR (SPY), you can begin trading as early as 8:30 a.m. (premarket) and begin tapering off around 10:30 a.m. As with stocks, trading can continue up to 11:30 a.m., but only if the market is still providing opportunities.

The middle of the day tends to be the calmest and most stable period of the trading day. During this time, people are waiting for further news to be announced. Because most of the day’s news releases have already been factored into stock prices, many are watching to see where the market may be heading for the remainder of the day.

Because prices are relatively stable during this period, it’s a good time for a beginner to place trades, as the action is slower and the returns might be more predictable.

In the last hours of the trading day, volatility and volume increase again. In fact, common intraday stock market patterns show the last hour can be like the first—sharp reversals and big moves, especially in the last several minutes of trading.

From 3 p.m. to 4 p.m. ET, day traders are often trying to close out their positions, or they may be attempting to join a late-day rally in the hope that the momentum will carry forward into the next trading day.

Best Day of the Week to Buy Stocks

There are some who believe that certain days offer systematically better returns than others, but over the long run, there is very little evidence for such a market-wide effect.

Still, people believe that the first day of the workweek is best. It’s called the Monday effect or the weekend effect. Anecdotally, traders say the stock market has had a tendency to drop on Mondays.

Some people think this is because a significant amount of bad news is often released over the weekend. Others point to investors’ gloomy mood at having to go back to work, which is especially evident during the early hours of Monday trading.

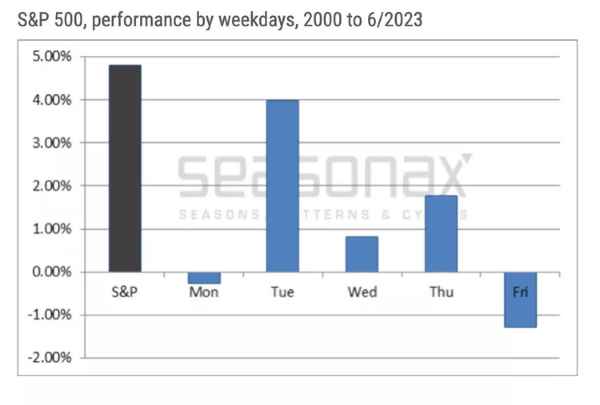

For whatever reason, the Monday effect has largely disappeared. The chart below shows that while Mondays on average have marked negative returns for the S&P 500 from 2000 to June 2023, the effect is very small.

Nevertheless, if you’re planning on buying stocks, perhaps you’re better off doing it on a Monday than on any other day of the week, and potentially snapping up some bargains in the process.

Best Day of the Week to Sell Stocks

If Monday may be the best day of the week to buy stocks, then Thursday or early Friday may be the best day to sell stock—before prices dip. If you’re interested in short selling, then Friday may be the best day to take a short position (if stocks are priced higher on Friday), and Monday would be the best day to cover your short.

In the United States, Fridays on the eve of three-day weekends tend to be especially good. Due to generally positive feelings before a long holiday weekend, the stock markets tend to rise ahead of these observed holidays.

Best Month to Buy Stocks

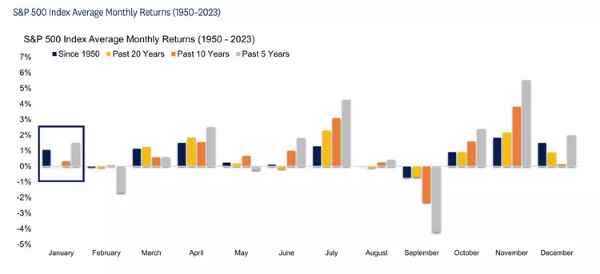

The markets tend to have strong returns in March, April, and July, and then the fall months into winter, October to December. The chart below shows the monthly average returns for the S&P 500 over the period from 1950 through 2023

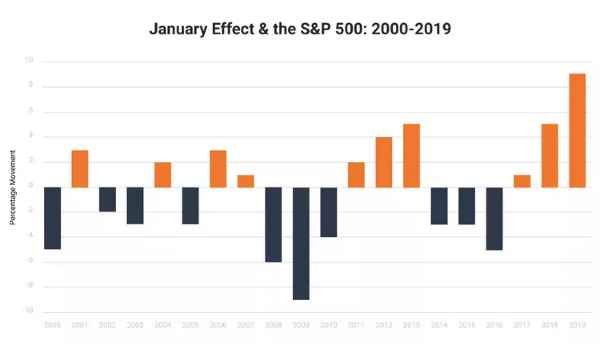

There’s something called the January effect. The idea that at the beginning of a new year, investors return to equity markets with a vengeance, pushing up prices—especially of small-cap and value stocks, according to “Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies” by Jeremy J. Siegel. But again, as information about such potential anomalies makes its way through the market, the effects tend to disappear. In the chart below, from 2000 to 2019, we see that January prices rose 10 times but also decreased 10 times

So again, the last trading days of the year can offer some bargains with an expected uptick in January, but it is not guaranteed.

Best Month to Sell Stocks

September is traditionally thought to be a down month. The September effect highlights historically weak returns during the ninth month of the year, which could be aided by institutional investors wrapping up their third-quarter positions. In fact, looking at the chart above of monthly average returns, September averages the worst in the calendar year. As a result, some traders believe that September is the best month to sell stocks.

The October effect is also salient for some investors. Even though October, on average, has been a positive month historically, many of the worst market crashes have occurred in this month (Panic of 1907, the Great Depression, and Black Monday). So while September may, on average, be a weaker month than October, you may want to sell in this month to avoid the above-average volatility that October can experience.

Best Date of the Month

There is no single day of every month that’s always ideal for buying or selling. However, there is a tendency for stocks to rise at the turn of a month. This tendency is mostly related to periodic new money flows directed toward mutual funds at the beginning of every month.

In addition, fund managers attempt to make their balance sheets look pretty at the end of each quarter by buying stocks that have done well during that particular quarter. Stock prices tend to fall in the middle of the month.

So a trader might benefit from timing stock buys near a month’s midpoint—the 10th to the 15th, for example. The best day to sell stocks would probably be within the five days around the turn of the month.

Are There Really Best Times to Buy or Sell Stocks?

Historically, some days or months have tended to be better or worse for stocks. These so-called market anomalies challenged theories of efficient markets. However, research shows that as these anomalies became more well-known and trading became more automated, these have largely all disappeared.

Is There a General Rule for Timing Trades?

The closest thing to a hard-and-fast rule is that the first hour and last hour of a trading day are the busiest, offering the most opportunities. But even so, many traders are profitable in the off-times as well.

How Does Dollar-Cost Averaging Help Investors?

Dollar-cost averaging is the practice of buying the same amount of a specific stock at consistent intervals. For example, you may buy five shares of stock ABC every two months, regardless of the price. This helps reduce price volatility and can potentially reduce the overall average price paid for each share. It also removes trying to time the market.

The Bottom Line

These suggestions for the best time of day to trade stocks, the best day of the week to buy or sell stocks, and the best month to buy or sell stocks are generalizations, of course. Exceptions and anomalies abound, depending on news events and changing market conditions.

Still, academic evidence suggests that any patterns in market timing where one can consistently generate abnormal returns are generally short-lived, as these opportunities are quickly arbitraged away and markets become more efficient as traders and investors increasingly learn about the patterns.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

Source: Investopedia, https://www.investopedia.com/day-trading/best-time-day-week-month-trade-stocks/