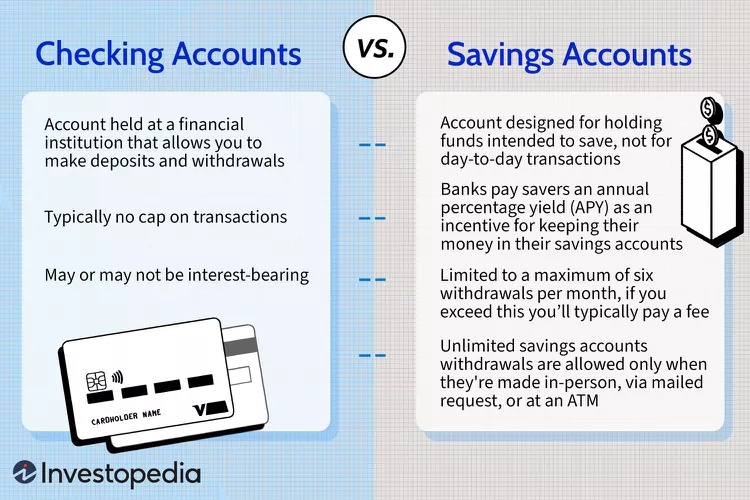

A checking account and a savings account have several key differences such as their interest rates and withdrawal rules. Both are bank accounts designed to keep your money safe. But a checking account is more for holding money for regular spending, while a savings account is designed for longer-term goals.

Learn more about the difference between a checking account and a savings account.

What Is a Checking Account?

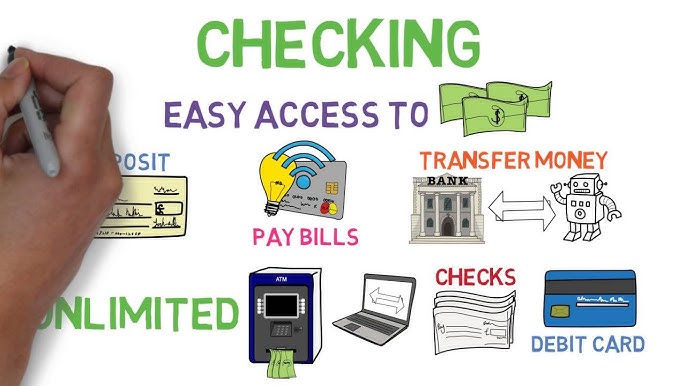

A checking account is an account held at a financial institution that allows you to make credit and debit transactions. These accounts can offer both a debit card and check-writing capabilities.

Withdrawals can take the form of cash withdrawals made at a branch or an automated teller machine (ATM), as well as debit card purchases, checks, money orders, ACH transfers, and wire transfers. Similarly, deposits can be made by depositing cash, checks, or money orders at a branch or an ATM, as well as via mobile check deposit, automated clearing house (ACH) transfer, or wire transfer.

“If you need to use funds for daily transactions, a checking account is the best way to do that,” John Bergquist, President at Lift Financial in South Jordan, Utah, said.

A checking account is useful if you need to:

- Pay bills electronically or via check

- Make purchases or ATM withdrawals using a linked debit card

- Transfer money to an account at a different bank electronically

Checking accounts may or may not be interest-bearing. If it is, the money you deposit earns interest as long as it stays in your account. These accounts can be offered by brick-and-mortar banks, online banks, credit unions, and other financial institutions.

What Is a Savings Account?

A savings account is a deposit account that’s designed for holding funds that aren’t earmarked for everyday use. For example, you might open a savings account to grow your emergency fund, set aside money for a vacation, or build your down payment.

Like checking accounts, savings accounts have different rates and are from different financial institutions like traditional banks, online banks, and credit unions.

You’re more likely to earn higher interest with savings accounts. Banks pay savers an annual percentage yield (APY) as an incentive for depositing and keeping money in their savings accounts. The APY savers can earn isn’t uniform, however. It can vary from bank to bank. On average the national savings rate was 0.46% as of Aug. 19, 2024.

“An online savings account is a much better option at almost 20 times higher a rate than the traditional checking account,” Bergquist says. “In fact, it’s even very similar to what you would earn when purchasing a 10-year Treasury bond.”

Online banks often have the capability to pass on higher interest rates to savers, owing to their lower overhead and operating costs. The rates can vary widely, but it’s not unthinkable to find high-yield online savings accounts from banks and credit unions earning an APY of up to 5.50%.

In addition to higher interest rates on savings, online banks may charge fewer fees. For example, a traditional bank may charge a monthly maintenance or minimum balance fee for a savings account. An online bank may not charge either of these fees.

Withdrawal Limits on Checking and Savings Accounts

An advantage of checking accounts is that withdrawals are virtually unlimited. You could use your card multiple times a day to shop, make daily cash withdrawals, and pay your bills without being penalized. But that may not be the case with your savings account. This started with Regulation D, which was a rule imposed on banks by the Federal Reserve.

According to Regulation D:

- Share savings accounts, savings accounts, and money market accounts (MMAs) were limited to a maximum of six withdrawals per month. Your account provider could charge excess withdrawal fees if you exceed the maximum number of withdrawals per month.

- Transactions that counted toward the limit included ACH withdrawals, overdraft transfers from savings to checking, transfers made via online banking or by phone, debit card point-of-sale (POS) transactions, and transfers or withdrawals made via fax.

- Unlimited withdrawals from savings accounts were allowed when made in person, via mailed request, or at an ATM.

Although Regulation D withdrawal restrictions were lifted in April 2020, some financial institutions may still charge their customers excess withdrawal fees if they’re made from a savings account. It’s always a good idea to ask your bank or credit union for the rules about your savings account so you’re not surprised with fees that you weren’t expecting.

Shop around to get the best deal—one that fits your needs and lifestyle. For instance, if you’re looking for a better return, some banks reward customer loyalty with higher rates if they open both a checking and savings account and link them together.

Checking vs. Savings Accounts: Which Is Better?

When comparing checking and savings accounts, you may find that one is better suited to your needs. In some cases, you may benefit most from using both. Here are some questions to consider when shopping around for a checking or savings account.

- What are the fees associated with the account? For example, is there a monthly maintenance fee?

- Is there a minimum balance requirement?

- Does a savings account come with an ATM card or a debit card?

- Are there daily limits on ATM withdrawals for checking accounts?

- Are there daily limits on deposits for a checking or savings account?

- Does the account earn interest, and, if so, what is the APY?

You should also check whether the bank offers any special perks for opening an account.

“Banks are highly competitive in a ridiculously low-interest-rate environment, and there are occasional incentives that could make a checking or savings account more attractive,” O’Donnell says. For example, you may be able to join a debit card rewards or discount program that could save you money. Or you could take advantage of promotional deals for opening other accounts, such as a money market or certificate of deposit (CD).

Lastly, keep in mind the kind of access you need when it comes to banking. Whether you choose a checking or savings account, consider whether the bank offers the online and mobile banking tools you need to manage your money digitally, the number of ATM locations, and whether branch banking is available, if that’s something you occasionally use.

Frequently Asked Questions (FAQs)

How Much Money Should You Have in Your Checking Account?

How much you should have in your checking account depends on a few key factors. If your bank requires you to hold a minimum balance in your account, you should at least have that amount or you risk being hit with service charges that eat away at your balance. But it’s always a good idea to keep at least one to three months’ worth of expenses in your checking account. This ensures you have enough to cover your living expenses and bills in case of an emergency.

What Do You Need to Open a Checking or Savings Account?

There are several things you’ll need before you can open a bank account of any kind, whether that’s a checking or savings account. That’s because the financial institution needs to verify your identity. This means you’ll need a valid piece of government-issued identification, such as a passport or driver’s license, proof of your address, or your Social Security number.4 If your bank has a deposit requirement, you’ll have to bring that with you, too.

Which Savings Account Earns You the Most Interest?

The interest rate on most savings accounts is fairly low. But that doesn’t mean all is lost as there are several options available for higher rates—you just have to look. Consider tiered accounts that offer higher rates as you deposit more money. Another option is the high-yield savings account, which pays more when you deposit a higher balance, usually over $5,000. If that’s not enough, you may want to open a money market account, which has the features of both a checking and savings account. This type of account uses the money you deposit to invest in other vehicles. But it’s still highly liquid.

How Do You Choose a Savings Account?

Savings accounts have several features to consider when choosing one for yourself. First, the interest rate will help you earn money. The higher the interest rate, the more you will earn. Compare the fees and withdrawal restrictions when shopping for a savings account.

The Bottom Line

Both checking accounts and savings accounts can be valuable tools in your financial life. While they both hold your money safely, they are designed for different purposes. With checking accounts, you can use your money to make convenient purchases. With savings accounts, you can earn some interest and keep your funds safe. Before you open a checking or savings account, compare different rates and terms to ensure you get the best account for you.

Investopedia