A money market account (MMA) is a neither a checking nor a savings account, but as a hybrid of the two it has certain similar characteristics of both. The best money market accounts lets account holders make withdrawals, transfers, and debit-card transactions as they would with a regular checking account, while often offering higher interest rates than traditional savings accounts.

A Short History of Money Market Accounts

Banks created hybrid money market accounts (MMAs) to offer more competitive interest rates than those offered by traditional savings accounts. But that doesn’t come without a cost. The tradeoff for higher rates is often a higher minimum deposit requirement.

With many MMAs, the account has to maintain a minimum daily balance (typically $1,000 and up) to receive the highest available interest rate. Many MMAs have tiered savings levels that offer higher interest rates for higher levels of savings.

MMAs became popular during the 1980s, when interest rates rose into the double digits, giving depositors an opportunity to generate high, risk-free returns. Deposits for MMAs are often invested in vehicles such as certificates of deposit (CDs), government securities, and commercial paper that offer higher yields than are generally found in savings accounts.

Checking or Savings?

There tends to be some confusion about what a money market account actually is. An MMA is neither a checking nor a savings account. But it does have certain characteristics that are similar to both. Money market accounts usually offer higher yields than traditional savings accounts.

They are able to offer a more attractive interest rate by setting higher minimum balance requirements, and through possible restrictions on the number of withdrawals that can be made over a given period of time.

Prior to April 24, 2020, as stipulated by the Federal Reserve’s Regulation D, MMA and savings account holders were limited to six withdrawals or transfers per month. If more than six withdrawals were made, an account could be charged a penalty. This limitation has been removed, but some banks still place limits on withdrawals and charge fees if you go over the number of transactions allowed.

Similarities to Checking Accounts

MMAs are deposit accounts insured by the Federal Deposit Insurance Corp. (FDIC). They are offered by banks, credit unions, and other financial institutions like those that operate online. An MMA has several benefits that resemble a checking account.

For example, many money market accounts offer debit cards and checks. This allows account holders to make cash withdrawals or purchases at retailers using the card. If the institution offers online banking privileges, customers can also make transfers and pay bills the same way they would with a checking account. And many MMAs allow unlimited ATM withdrawals and in-person debits at a bank branch. But the number of other types of withdrawals you’re allowed every month may be limited.

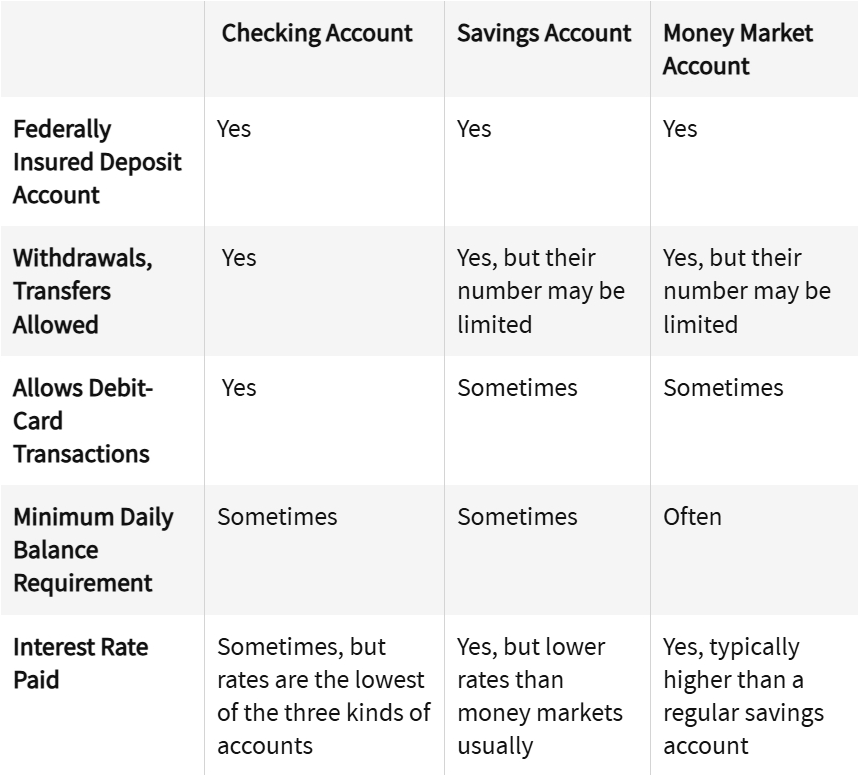

Comparison of Checking, Savings, and Money Market Accounts

Savings Element

While it has some elements of a checking account, the main point of an MMA is the savings portion. This means the account balance earns interest, and the interest rate paid is usually higher than what a traditional savings account earns. Many MMAs offer interest based on a tiered balance; lower balances get a lower rate, while higher balances are rewarded with more interest.

Institutions can justify the higher interest rate by setting a minimum balance requirement. If your balance goes below this amount, the bank may be able to cut the high interest rate down. Banks can also charge fees for not meeting the minimum balance.

Can You Lose Money in a Money Market Account?

You can’t lose money in your money market account unless you deposit more than the federally insured amount of $250,000 and the institution fails. Money market accounts at banks are insured by the Federal Deposit Insurance Corp. (FDIC) and by the National Credit Union Administration (NCUA), if the account is at a credit union.

Is It Worth It To Put Money in a Money Market Account?

Whether it’s worth putting money into a money market account depends on the needs of each individual. A money market account may come with a higher interest rate than a traditional savings account, allowing the account holder to earn more money on their deposits. Money market accounts have easier access than traditional savings accounts and are also protected by either the FDIC or NCUA. But money market accounts do tend have higher minimum balance requirements that need to be maintained.

What Is the Difference Between a CD and a Money Market Account?

A money market account offers the benefits of both a checking account and a savings account: easy access to funds and higher interest earned on deposits. A certificate of deposit (CD), on the other hand, ties up cash for a certain period of time, making the money inaccessible to the account holder.

The Bottom Line

Money market accounts are suitable for people who can meet minimum balance requirements that might be higher than a traditional savings account requires, in return for a higher interest rate on their savings when compared with traditional savings accounts. Money market accounts usually allow account holders to make withdrawals and transfers, and may allow debit-card transactions and online bill pay like regular checking accounts. But be aware that there may be limits on how frequently you can make withdrawals or transfers from a money market account.

Trade on the Go. Anywhere, Anytime

One of the world’s largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You’ll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

Source: Investopedia, https://www.investopedia.com/ask/answers/060116/are-money-market-accounts-considered-checking-or-savings.asp